Mortgage Dove

Constructions Loans: What Is It and How To Get One?

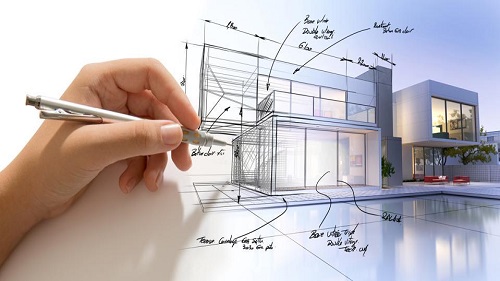

If you cannot find the right house to purchase, you may be contemplating how much it would cost to construct a new home or remodel the one you call home. How to obtain cash to fund the construction project differs from getting a mortgage for moving into an existing house. This article will provide everything you need to be aware of when applying for a construction loan.

What is a construction loan?

Home construction loans are short-term, high-interest loans that can provide the money needed to construct a residential home. The typical construction loan is for one year. At this time, the home must be constructed and the certificate of occupancy must be issued.

There are other loan options for the construction of homes ranging from basic building to total renovation of the whole house. There's a loan that's suitable for your needs, whether you're beginning from scratch using an initial home loan and completely reconstructing your house.

- Construction-Only Loan

This kind of loan is not long-term and typically granted for one year. It's intended to cover the actual construction time. With so many variables, such as the builder's cooperation, obtaining approval from local municipalities, and so on. These loans are considered higher-risk loans. It means that they're more difficult to obtain, and the interest rate will probably be higher than the traditional loan. Additionally, if you opt for this option, you'll be required to pay another set of loan fees to apply for a traditional mortgage.

- Construction-To-Permanent Loan

Construction-to-permanent financing is a one-time loan that funds construction and then converts it into a permanent mortgage. In the phase of construction, the borrowers pay interest only. These kinds of loans can be more costly than traditional mortgages. So should you choose to take this route, take your time, research for rates, compare rates, and locate the most competitive rate before committing? If you're an active-duty veteran or service member, you may be eligible for the Veterans Administration construction loan.

- Renovation Loan

The loans for renovation, commonly referred to as FHA 203(k) loans, can be utilized to complete home improvements and are covered through the Federal Housing Administration (FHA). These loans allow borrowers to buy and remodel their new homes while making a monthly payment that covers the costs of both. Conventional loan borrowers can be eligible to receive these loans via Fannie Mae ( HomeStyle Renovation) and Freddie Mac(CHOICE Renovation).

Other options are a home equity loan or a home equity line of credit (HELOC) . Whatever you're looking to improve in your house, there are many ways to obtain the money you'll need to get started with your sledgehammer.

- Owner-Builder Loan

In the majority of cases when building homes, there's usually the general contractor, who is the head of the entire process. They ensure that all the framing workers, the tile folks, the wood floor folks, and the painters all work together to finish your house (ideally within the timeframe and on the budget).

However, some potential home builders want to operate like self-contained general contractors, and some banks will offer owner-builder-only loans to help with this. These loans typically require the borrower by their education, experience, and certification that they have the necessary expertise and knowledge to manage the home building.

- End Loan

The term "end loan" refers to a type of credit line that mortgage lenders offer to a home buyer or a home construction company may apply for once the building of the home has been completed. There is a possibility of getting an end loan if the house is completed. The benefit of an end-loan is that the application for a mortgage process for new construction homes is identical to that for other homes.

What are the construction loan rates and terms?

The borrower can apply for construction loans and submit financials, plans, and timetables. If the loan is approved, the lender will begin drawing funds with each stage of the project. Typically, they'll only be paying interest during the construction. Throughout the construction process, the appraiser or inspector assesses the build to approve additional funds. When construction is complete, the borrower typically converts the loan into a permanent mortgage and starts repaying the principal and the interest.

The majority of construction loans come with variable rates that fluctuate upwards and downwards with an increase in the interest rate. Rates for construction loans are usually more expensive than traditional mortgage rates. In a traditional mortgage, your home is like collateral . If you fail to pay your mortgage, the lender can take your home. When you take out a home construction loan, however, the lender isn't given the option of seizing your home, and they consider these loans to be higher risk. On average, the interest rates on these loans rise around 1% point more than conventional mortgage rates, typically falling between 5%-10%.

The initial loan term usually lasts for the duration of the construction project. Because construction loans run on an extremely short timeline and are contingent on the successful completion of the construction project, you'll need to supply the lender with an estimated timeline for construction, precise plans, and a realistic budget.

What are the construction loan requirements?

The firms that provide construction loans require borrowers to:

- Be financially secure. To get a construction loan, you'll require a low debt-to-income ratio and the ability to show enough income to pay back the loan. Generally, an average credit score of at minimum 680 is required.

- Make an installment amount. You need to pay a down payment before applying for your loan. The amount you pay will be contingent upon the loan provider you select and the amount you want to borrow for construction. However, loans for construction typically require at least 20% down.

- Create a construction schedule. If you have elaborate plans and a project schedule created by the construction company you're working with, it could assure lenders that everything will be completed according to the plan and that you'll be able to pay back the loan.

- Secure a home appraisal. The finished home is used as collateral for a loan, and lenders must ensure that the collateral will suffice to guarantee the loan. To do this, they might require an appraisal to estimate how much your house is worth.

How do you get a construction loan?

In general, if you're wondering what you need to do to obtain the construction loans, take these steps:

- Find a licensed builder: If you know friends who have constructed the homes of others, get suggestions. It is also possible to consult the NAHB's directory of local builders associations to locate builders in your region. As you would evaluate several homes before purchasing one, it's advisable to look at different builders and find the right combination of cost and experience that best suits your needs.

- Gather your documents: A lender will likely require an agreement with your builder which contains specific pricing and plans for the construction project. Include references for your builder and other necessary evidence of their professional credentials. You'll also need to provide documents like tax stubs and pay statements.

- Pre-approve: Getting preapproved for construction loans will give you an understanding of much you'll be in a position to borrow for your project. It is an essential option to avoid having to pay for plans drawn by an architect or drawing out plans for a house that isn't something you'll be able to pay for.

- Purchase homeowners insurance. Even though you're not living in your house yet but your lender is likely to require a prepayment homeowner's insurance plan which includes the builder's risk insurance. It means that if something occurs during the construction process such as the property that is half-built is set on fire or someone damages the building, for instance -you're covered.

"Mortgage Dove makes home financing convenient for every American. You can count on us to provide a home buying experience tailored to your personal needs and financial situation. We strive to give you the peace of mind that your home financing goals can be achieved.”

Mortgage®

www.mortgagedove.com